Reverse mortgages have become common in both the real estate and financial world. Are you interested in getting a reverse mortgage, then you have several options. The single disbursement lump-sum payment is one of the six ways on how you can receive reverse mortgage proceeds. As a borrower, you will receive a single lumpsum payment when the loan closes. You should know that there will be no further proceeds later afterward.

The reverse mortgage lumpsum payment plan is the only one that has a fixed interest rate. The interest isn’t only inclusive of the lumpsum amount but also financed closing costs, insurance premiums as well as mortgage insurance premiums. When the reverse mortgage is due for payment, the borrower should expect all these costs will be tallied together.

A Further Understanding of the Reverse Mortgage Lumpsum Payment Plan

There is no doubt that reverse mortgage payment plans can be a bit confusing. Especially when you have to choose a payment plan suitable for your needs. The single disbursement payment plan allows the borrower to get a large amount of money when the loan is due.

Unlike other plans, however, the lumpsum payment plan has a fixed rate. As a result, its rate tends to be higher. Other repayment plans usually have an adjustable rate. A reverse mortgage lumpsum repayment plan is a bit similar to a borrower’s first mortgage.

It’s Benefits

The advantage of a lumpsum payment plan is that, despite the rates being higher, you will know what your total borrowing costs are. Adjustable rates are, at times, not a great option. This is because the prices may fluctuate and you can’t know what your borrowing costs are.

This kind of payment plan can be of great benefit to folks who want to pay off a big balance on their first mortgage. Or, they need to cater to a considerable expense that has come their way. Also, it is suitable for homeowners who want to receive a large amount of money in bulk that is not accompanied by later proceeds.

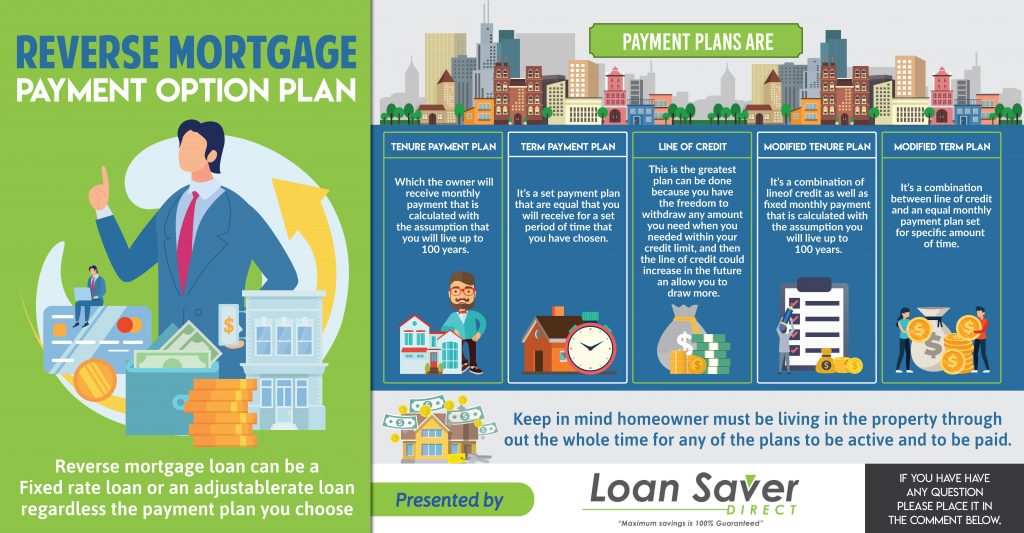

If you wish to receive monthly payments, then the lumpsum payment plan isn’t ideal for you. It is better if you choose a payment plan with an adjustable rate. You can opt for the line of credit, tenure payments, term payments, or a combination of the first two options. The choice is entirely up to you. You can also opt for the alternative where you get to borrow as needed.

You should also know that if a borrower has a history of not correctly managing large amounts of money, then the lumpsum repayment plan isn’t your best option. There have also been cases where some fraudsters have used the lumpsum payment plan to rip off their seniors. Before you are approved for a lumpsum payment plan, you should expect to undergo some scrutiny from the financial institution.

Back in 2013, there was an implementation of a regulation where a homeowner is allowed to borrow a maximum of 60% of the primary principal. This is one of the most significant drawbacks of the lumpsum payment plan.

For instance, let’s say a homeowner wishes to borrow $300,000. If they opt for the lumpsum payment plan, they only get 60%, which is 180,000. This rate appears to be unfavorable compared to another homeowner who would get the $300,000 if they would have used a different payment plan.

Note that the remaining percentage acts as home equity. On the bright side, the remaining balance can be later on used to pay off the reverse mortgage. Also, the borrower is granted freedom to opt for another payment plan, which can be repaid by the remaining 40%. However, when switching payment plans, you need to be extra careful since the change in rates could lower the amount you had expected to receive.

Final Thoughts

To qualify for a reverse mortgage, you must be a homeowner and must remain in your primary residence during the payment period. Additionally, you will maintain full title and ownership of your home. You will, however, remain responsible for taking care of your property and catering for expenses such as home insurance and property taxes. Most lenders will also allow borrowers to make advance interest payments if they so wish to reduce the amount owed at the end of the reverse mortgage.