As responsible financial commentators, we understand that navigating the complexities of reverse mortgages is vital for our aging community seeking to benefit from their hard-earned home equity. While reverse mortgages can provide an enticing tax-free income stream for those over 62, they come with inherent reverse mortgage risks. These financial risks for seniors, which may involve steep loan terms and even the forfeiture of their homes, are often obscured by the appealing projections seen in advertisements. Our mission is to guide homeowners through the intricacies of reverse loan issues, ensuring they are fully informed of the long-term financial stakes that come with this kind of borrowing—including the dreaded possibility of foreclosure.

We will delve into the often-overlooked facets of reverse mortgages to empower homeowners with the knowledge necessary to make informed decisions. It’s crucial that seniors consider not only the immediate benefits but also the financial implications over time, such as increased debt from interest and fees, which could ultimately lead to the loss of their home. In order to protect one’s financial future and home ownership, being informed about all aspects of reverse mortgages is indisputably crucial.

Key Takeaways

- Reverse mortgages are a unique financial tool available exclusively to seniors aged 62 and above.

- Homeowners should be alert to the financial risks for seniors, including expensive loan terms and potential foreclosure.

- It’s essential to understand the long-term implications of reverse mortgage rates, fees, and interest accumulation.

- Reforms have provided additional protections for non-borrowing spouses, yet risks remain.

- Reverse loans can influence eligibility for certain government benefits, which must be carefully considered.

- There are alternatives to reverse mortgages, such as HELOCs or downsizing, that could be more suitable for some seniors.

- While the loan itself doesn’t affect Social Security or Medicare, the impact on Medicaid and SSI requires scrutiny.

Understanding Reverse Mortgages and Their Appeal

As we delve into the complexities and functionalities of reverse mortgages, it becomes apparent why they are a strategic option for homeowners aged 62 and over. Before exploring the benefits it offers to seniors, let’s define what a reverse mortgage entails.

Defining a Reverse Mortgage

A reverse mortgage is essentially a financial agreement that allows seniors to convert part of the equity in their home into cash. The unique aspect of a reverse mortgage, which differentiates it from other types of loans, is that repayment isn’t required until the homeowner sells the house, moves out, or passes away. It’s crucial to understand the reverse mortgage definition thoroughly to grasp its long-term implications, such as equity depletion risk and loan repayment challenges.

Benefits for Seniors: Income Stream and Equity Access

Seniors often face financial pressures that stem from insufficient retirement savings, unexpected medical expenses, or the need for home modifications to accommodate aging-related issues. Here, reverse mortgages can serve as a vital financial tool by providing a steady stream of income or a lump sum payment based on the home’s equity. Unlike traditional home equity loan risks, HECMs (Home Equity Conversion Mortgages) are backed by the Federal Housing Administration (FHA), which secures several payment options suited to the homeowners’ needs.

The table below illustrates various features and requirements for obtaining a reverse mortgage, emphasizing its accessibility and flexibility:

| Feature | Details |

|---|---|

| Eligibility Age | 62 years and older |

| Home Equity Requirement | Own home outright or substantial equity |

| Payment Options | Lump sum, monthly payments, line of credit |

| Insurance | FHA-backed HECM insurance |

| Counseling | Mandatory consultation with approved counselor |

| Tax Implications | Loan advances not taxed as income |

| Heir Responsibility | May need to sell the home to satisfy the loan if unpaid |

Understanding the advantages and overseeing the responsibilities associated with reverse mortgages can significantly impact seniors’ financial strategies, aiming to provide them with peace of mind and financial security in their later years. The appeal lies not only in the income stream and equity access but also in the empowerment it offers seniors, giving them the financial autonomy and the ability to live out their retirement comfortably. These features underscore the importance of thorough planning and advice from financial and legal experts before making decisions on reverse mortgages.

Common Types of Reverse Mortgages and Their Features

When considering financial solutions for retirement, many homeowners explore the various types of reverse mortgages available. These tools allow seniors to tap into their home equity to cover expenses, enhance their retirement income, or meet urgent financial needs without the obligation of monthly mortgage payments.

The most prominent and widely utilized among these is the Home Equity Conversion Mortgage (HECM), renowned for its HECM features and flexibility. To cater to different financial circumstances and home values, other options such as proprietary reverse mortgages and single-purpose reverse mortgages also exist, each with distinct advantages and regulatory frameworks.

- Home Equity Conversion Mortgages (HECMs): Federally insured and the most common, HECMs offer a range of disbursement options including lump-sum payments, monthly advances, or a line of credit. Eligibility hinges on the homeowner being 62 years or older, maintaining the property as a primary residence, and undergoing a counseling session. Flexibility in spending and high borrowing limits underscore the popularity of HECMs.

- Proprietary Reverse Mortgages: Tailored for higher-value homes that surpass federal lending limits, these private loans can offer larger loan amounts. Without federal insurance, proprietary loans typically come with higher interest rates and fees, making them suitable for homeowners with substantial home equity.

- Single-purpose Reverse Mortgages: Offered by state and local governments, or nonprofits for specific aims like home repairs or property taxes, these loans are generally the least costly but are limited by income restrictions and the intended use of the funds.

| Type of Reverse Mortgage | Key Features | Typical Users |

|---|---|---|

| HECM | Federally insured, various payment options, higher borrowing limits. | Homeowners aged 62+, diverse financial needs. |

| Proprietary Reverse Mortgage | Higher loan amounts, not federally insured, suitable for high-value homes. | Owners of high-value properties, substantial home equity. |

| Single-purpose Reverse Mortgage | Lower costs, restricted to specific uses, income limitations. | Financially constrained homeowners, specific financial challenges. |

Each option is uniquely tailored to fit different needs and circumstances. For instance, HECMs are preferable for individuals seeking flexible withdrawal plans and significant loan amounts due to their HECM features. On the other hand, single-purpose reverse mortgages can be ideal for those with specific, immediate financial needs, offering low costs and subsidies. Proprietary loans fill the gap for those with properties exceeding typical value limits imposed by federal HECM regulations.

In summary, understanding the differences among the types of reverse mortgages can guide homeowners to make informed decisions that best suit their financial strategies in retirement. As these financial instruments bear considerable implications, personalized advice and thorough comparative analysis remain crucial in the decision-making process.

Reverse Mortgage Rates and Fees: The Financial Implications

Exploring the fiscal burdens of reverse mortgage expenses uncovers a complex layer of costs that can significantly impact retirees’ financial stability. As we navigate through these intricacies, it’s essential to consider both the immediate and long-term financial implications of securing a reverse mortgage.

Initial Costs and Ongoing Fees

The entry to a reverse mortgage starts with substantial up-front costs. These can include origination fees, which might climb depending on the total loan amount, and upfront mortgage insurance premiums fixed at 2% of the home’s appraised value. Our research indicates that for every $100,000 in home value, this equates to a $2,000 charge.

Beyond the initial expenses, homeowners face ongoing costs that add to the loan balance growth, contributing to the reverse mortgage expenses. These include annual mortgage insurance premiums equivalent to 0.5% of the outstanding loan balance and potential servicing fees. It is the accretion of these fees over time that intensifies the financial strain, making reverse mortgages more costly compared to traditional loans.

Interest Accumulation and Its Impact

Undoubtedly, the impact of interest accumulation stands as a formidable force in the realm of reverse mortgages. Interest, typically variable, accumulates monthly, leading to an incrementally increasing loan balance. Given the variable rates tied to indices like the SOFR plus a margin, these can shift subject to market dynamics, thereby affecting the total repayment amounts significantly.

This gradual increase in loan balance via compounded interest can erode home equity swiftly, leaving less for heirs and escalating the risk of loan foreclosure. It’s a scenario that demands careful consideration from potential borrowers, particularly those looking to preserve family inheritance or who are uncertain about long-term residency plans.

Here’s a comparative look at the costs associated with different reverse mortgage products:

| Type of Reverse Mortgage | Upfront Costs | Ongoing Fees | Interest Type |

|---|---|---|---|

| HECM | $2,000 per $100,000 value | 0.5% annual premium | Variable |

| Proprietary Reverse Mortgage | Vary by lender | Variable by lender | Variable, usually higher than HECM |

| Single-purpose Reverse Mortgage | Low or none | Minimal | Fixed or Variable |

The long-standing appeal of reverse mortgages lies in their ability to offer financial relief and lifestyle maintenance. However, the increasing costs, compounded by the impact of interest accumulation, necessitate a thorough understanding and strategic planning to mitigate the risks associated with loan balance growth and potential loan foreclosure.

Deconstructing the Reverse Mortgage Risks

Understanding the complexities and risks associated with reverse mortgages is critical for homeowners considering this financial option. We delve into some significant concerns, notably the long-term financial risk and the potential for homeownership loss, which can significantly impact retirees’ financial stability and residential security.

Assessing Long-term Financial Risk

The allure of reverse mortgages can be strong, providing a stream of income by tapping into home equity. However, this financial strategy carries inherent long-term financial risks. Equity depletion risk is a significant concern as the loan balance increases over time, often outpacing the home’s value, especially if the property’s market value stagnates or declines. Such scenarios can limit a homeowner’s future financial options, be it moving to a new home, managing unexpected expenses, or planning inheritances.

Homeownership Loss Risks

The risk of foreclosure remains a poignant reality for those who fail to meet their reverse mortgage obligations, which include maintaining their home and keeping up with property taxes and insurance. Foreclosure not only displaces the homeowner but also potentially affects non-borrowing family members residing in the property. It’s crucial to understand that the loan becomes due when the homeowner passes away or decides to move out, leading to significant homeownership loss risks for families not adequately prepared for these eventualities.

| Factor | Impact on Homeownership |

|---|---|

| Home Maintenance | Neglecting property upkeep can lead to foreclosure. |

| Property Taxes | Failure to pay taxes increases the risk of losing the home. |

| Insurance | Lack of insurance can violate mortgage terms, leading to potential foreclosure. |

| Loan Due Date | Passing of homeowner or relocation can trigger loan repayment, risking foreclosure if funds are insufficient. |

To safeguard against these risks, prospective borrowers are advised to consider their long-term financial plans and discuss with family members about the implications of a reverse mortgage on their homeownership and estate plans. Understanding and preparing for these risks can lead to a more secure financial future.

Government Benefits and Reverse Mortgage Effects

When seniors consider financial strategies for their retirement, understanding the interplay between reverse mortgages and government benefits is crucial. Not only does this knowledge protect valuable income sources, but it also ensures that seniors can manage their resources effectively.

Impact on Medicaid and SSI Eligibility

One key concern with the financial setup of reverse mortgages is their potential to affect eligibility for Medicaid and Supplemental Security Income (SSI). These programs have strict asset limits, and unfortunately, lump-sum payments or sizeable account balances from reverse mortgages could be viewed as assets. This classification requires managing these funds prudently to avoid breaching eligibility thresholds. As government benefits provide essential support, it’s important for seniors to consider the implications of these assets on their qualifications for such aid.

Non-Effect on Social Security and Medicare Benefits

On a brighter note, the funds from a reverse mortgage do not impact Social Security or Medicare benefits. This aspect of reverse mortgage effects brings a sigh of relief to many, as these benefits form the backbone of senior financial stability in the U.S. However, staying informed and vigilant about how other government benefits might interact with one’s financial decisions is a wise strategy for any senior.

As we delve deeper into the reverse mortgage effects, it’s beneficial to look at the bigger picture. Here’s a quick glance at some key points:

| Factor | Effect on Government Benefits | Additional Information |

|---|---|---|

| Asset Limits | Potential Disqualification for Medicaid/SSI | Lump-sums count as assets, requiring spend down. |

| Social Security | No Impact | Monthly or line-of-credit withdrawals are not seen as income. |

| Medicare | No Impact | Medicare eligibility remains unaffected by reverse mortgage proceeds. |

This table offers a simplified overview, but the underlying strategies can be complex. Whether considering a reverse mortgage due to its appeal of not affecting Social Security and Medicare benefits or hesitating because of potential negative reverse mortgage effects on other government benefits, it’s crucial to navigate these waters with detailed information and if possible, guided advice from financial experts specialized in elder finance.

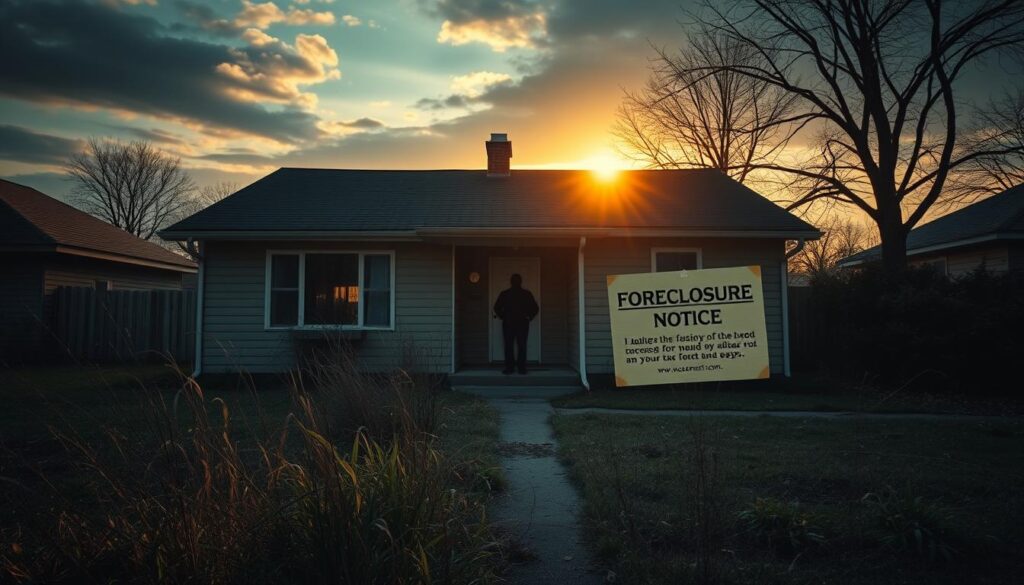

Reverse Mortgage Risks: Foreclosure Possibilities

When considering reverse mortgages, understanding the loan foreclosure risks and other reverse mortgage pitfalls is crucial. These loans can provide financial relief for aging homeowners; however, they come with stipulations that, if unmet, can lead to foreclosure, ultimately causing the homeowner to lose their property.

For instance, homeowners are required to maintain their property, pay property taxes, and keep up homeowners insurance. Failing to meet these obligations can trigger a foreclosure event. Additionally, if a homeowner moves out or passes away, the loan becomes due. If the amount cannot be repaid timely, the home may be foreclosed and sold to satisfy the debt.

| Aspect | Regulation | Impact |

|---|---|---|

| Non-payment of property taxes | Required continuously | Can trigger foreclosure |

| Home Insurance Maintenance | Must be maintained | Failure leads to potential loan default |

| Property Condition | Mandatory upkeep | Essential to avoid loan default |

| Residency Requirement | Primary residence only | Absence over 12 months triggers default |

This underscores the importance of diligently planning and maintaining all loan-associated responsibilities to mitigate foreclosure risks. Remember, while reverse mortgages may provide financial comfort, staying aware of loan foreclosure risks and reverse mortgage pitfalls ensures sustained homeownership and financial stability during retirement.

The Other Side: Family Members and Heirs Considerations

When exploring the realm of reverse mortgages, it’s crucial to consider not only the borrower but also the impact on family members and heirs. This broader perspective unveils potential financial and emotional challenges, especially concerning eviction for non-borrowing spouses and the burdens placed on heirs.

Risks of Eviction for Non-Borrowing Spouses

One significant concern arises with the eviction for non-borrowing spouses when the borrowing spouse passes away or moves into long-term care, which prompts the mortgage to become due. Reforms have been initiated to provide some spouse protections, yet non-borrowing spouses might still find themselves at risk if they aren’t contractually co-borrowers. They may face the harsh reality of needing to either settle the loan balance promptly or face eviction, a distressing scenario for anyone grieving the loss or incapacity of a partner.

Smaller Inheritances and Potential Hassles for Heirs

The financial implications for heirs are equally daunting. Inheritance risks grow as reverse mortgages deplete home equity, potentially leaving a balance that might exceed the home’s value. This reduction in inheritance can surprise heirs, not merely touching their anticipated wealth but also placing upon them the heir burdens of resolving the estate. Heirs are usually faced with choices that include repaying the loan promptly, selling the property to cover the debt, or handing over the deed to the lender.

The scenario often involves intricate decisions and tight timelines. Heirs have precise windows—typically about six months with possible extensions—to decide their course of action, which can be an emotionally and logistically taxing experience. Whether they choose to retain the property or sell it, heirs must navigate financial strategies to either clear the debt or manage the outcome of a sale, possibly without any remaining equity.

Understanding these challenges can help families plan more effectively for the future. With careful estate planning and clear communication, it’s possible to mitigate some of the inherent risks of eviction for non-borrowing spouses and reduce the heir burdens that can come with inheriting property under a reverse mortgage framework.

Alternatives to Reverse Mortgages: Weighing Your Options

As we explore viable alternatives to reverse mortgages, it’s critical to weigh the benefits and drawbacks of each option to determine the most suitable path for seniors looking to leverage their home equity. Understanding the potential implications of these choices can lead to more informed financial decisions.

Home Equity Loans and HELOCs

A home equity loan offers a lump sum, fixed interest rate, and consistent monthly payments, which can be an attractive alternative for those needing straightforward financial solutions. However, home equity loan risks include the possibility of foreclosure if payments aren’t maintained. On the other hand, a Home Equity Line of Credit (HELOC) provides flexible access to funds up to an approved limit, proving to be useful for ongoing expenses. It’s crucial to consider HELOC alternatives when the variable interest rates associated with them might increase the total cost of borrowing over time.

Downsizing or Refinancing as Alternative Strategies

Downsizing to a smaller, more affordable home can offer significant financial relief and lower living expenses. Nevertheless, there are downsizing risks such as the emotional and physical toll of moving, which might not be appropriate for everyone. Refinancing your existing mortgage to secure better interest rates and potentially lower monthly payments presents refinancing opportunities, allowing homeowners to adjust their financial burdens without forfeiting their homes.

In summary, when considering the shift from a reverse mortgage to another financial strategy, it’s important to assess all associated risks and opportunities. Whether opting for a home equity loan, exploring HELOC alternatives, considering downsizing, or seeking refinancing opportunities, informed decisions are paramount. Consulting with financial advisors and comparing different offers from lenders can further aid in finding the right solution tailored to individual financial needs and circumstances.

Conclusion

In light of the evidence and statistics provided in our discussion, it’s clear that reverse mortgage risks are a critical consideration for seniors looking to navigate these complex loans wisely. With about 50% of applicants being under the age of 70, according to the AARP, the growing popularity of Home Equity Conversion Mortgages (HECMs) raises the urgency for informed decision-making. The appeal of reverse mortgages cannot be overlooked, especially when banks may charge up to 5% of a home’s value in fees, coupled with interest rates that can compound to substantial amounts over time, a stark reminder of the gravity these financial decisions carry.

The impact of reverse mortgages extends beyond immediate cash flow benefits, as they can safeguard social security and Medicare eligibility while ensuring that any remaining proceeds are bequeathed to one’s heirs. Yet the National Council on Aging emphasizes the importance of thorough reverse mortgage counseling from multiple sources, highlighting the manifold intricacies of these loans. With one in ten reverse mortgages potentially leading to foreclosure, the shadow of financial strain looms large, especially when considering the plummeting numbers of FHA-backed loans from over 114,000 in 2009 to 61,296 in 2013—suggesting a recalibration in the market’s stability and reliability.

As we consider the shift from traditional pension plans to more retirees relying on reverse mortgages, the observation that more than half of borrowers were under age 70 in 2011 underscores a demographic trend towards earlier reliance on home equity. With an 80% lump sum withdrawal increasing delinquency rates and heightening foreclosure risks, our collective mission pivots towards advocacy for due diligence and long-term strategic planning. As ever-changing economic conditions reshape retirement paradigms, such as the Social Security wage replacement rate’s forecasted decline, reverse mortgages may seem alluring but require a discerning eye to assess their suitability and sustainability alongside alternative options. Let us remember the lessons harvested from the housing crisis and proceed with prudence to ensure that our financial legacy is as secure as our bricks and mortar investments.