An Introduction to a Home Equity Conversion Mortgage

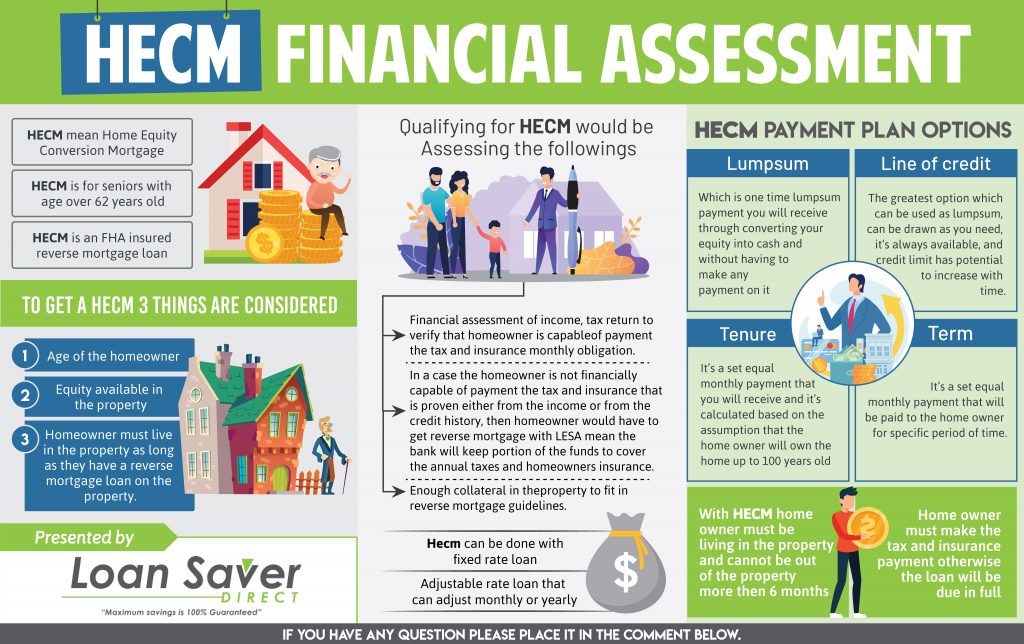

A home equity conversion mortgage, often abbreviated as HECM, is available to homeowners age 62 and over and is a form of Federal Housing Administration (FHA) insured reverse mortgage. Through this mortgage, senior citizens can convert their home’s equity into cash.

The home’s appraised value determines how much they can borrow, though this amount is subject to FHA limits. With this type of loan, no payments must be made until the home is sold or the borrower(s) pass away, though interest does accrue on the outstanding loan balance. At the time of sale or the borrower(s) death, the loan must be paid off in full.

An In-depth Look at HECMs

A popular form of reverse mortgage, HECMs are similar to privately offered reverse mortgage products available through banks. The major difference is that reverse mortgages obtained through banks usually allow for higher borrowing amounts with lower costs. HECMs usually offer the lower interest rate.

When choosing between a HECM and a privately sponsored reverse mortgage, you should consider:

- The age of the borrower(s)

- How long the borrower(s) expects to own the home and/ or live

HECMs are also comparable to home equity loans, which is also a type of reverse mortgage. In the case of a home equity loan, the borrower(s) are given a cash advance based on their mortgage collateral’s equity value. Home equity loans have standard borrowing terms and require monthly payments be made.

Who is Eligible for HECM?

As mentioned above, the Federal Housing Administration sponsors HECMs and offers insurance on the products. As such, they also determine the guidelines for the eligibility of these loans. HECMs can only be obtained from banks where the product is sponsored by the FHA. The potential borrower must fill out a standard application, as well as provide any requested additional information.

The borrower must be age 62 or over and the property must be substantially paid off and have significant equity available.

For approval, the borrower(s) must meet all of the HECM’s requirements, which are determined by:

- The borrower’s profile

- The borrower’s financial situation

The property’s collateral value Although payments are not required on HECMs, fees may be due for the servicing of the loan at the time of the loan’s closing