Are you looking for the best mortgage payment plan? Look no further! When it comes to reverse mortgage funding payment options, most people are faced with the challenge of choosing a payment that will be most suitable for them.

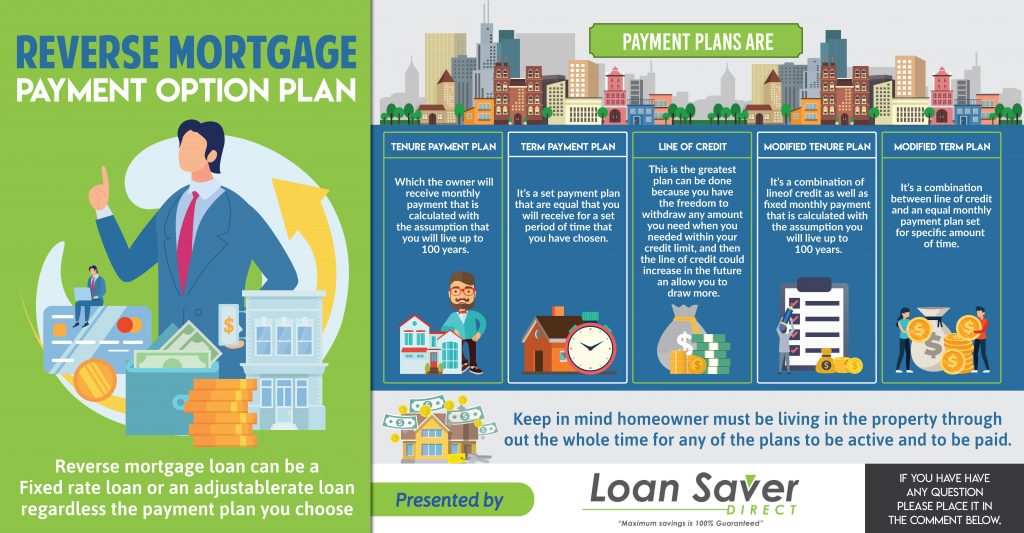

There are about six different ways in which you can receive proceeds from the various popular types of the reverse mortgage. According to the U.S department of housing and urban development these options are called payment plans. You can choose to either establish a line of credit which you can withdraw as required, receive a large lump sum of money, select a combination of these methods, or receive monthly payments that are equal.

Below, we will discuss the various reverse payment options that you can consider. The information is meant to help you learn about options that might be suitable for you.

One thing you need to note, however, is the fact that the amount of money you receive will be affected by the plan you choose, either in the short run or long run. Other factors that might affect the money you receive include how your financial goals are effectively assisted by the reverse mortgage and also how fast you use the home equity.

Fixed-Rate Payment Plan

The fixed-rate payment plan only comes with one optional payment, which is the single-disbursement lump-sum payment plan. In this payment plan there is a large amount of money that you receive after the closing of your reverse mortgage. The interest is accrued on the insurance premiums of the ongoing monthly mortgage, and also the financed closing costs until your reverse mortgage is termed due or payable. Compared to the adjustable payment plan, the interest rate of the fixed-rate payment plan is higher although it lowers over time. The advantage of this plan is that it is suitable when you want to cover large expenses or pay off a high mortgage balance. The drawdown of this plan is that in the future you will be unable to receive any additional proceeds.

Adjustable Payment Plan

Adjustable rates are included in the other five mortgage payment plans. Choosing any one of them provides different possibilities about how your interest rate can change, and your mortgage will only be applied to one. The good thing is that in your loan paperwork this will be disclosed.

Here are the three different ways in which this might turn out:

- Based on the margin established by your lender and the Constant Maturity Treasure (CMT) index, there will be an adjustment of your interest rate monthly.

- Your interest rate may adjust once per years based also on the margin established by your lender as well as the CMT index.

- Your interest rate may adjust monthly based on the interest rate established by your lender and the London Interbank Offered Rate.

Note that each of the scenarios outlined above matter a lot because they affect how much interest is accrued over time by your loan. However, they don’t matter that much when it comes to the available line credit or your scheduled monthly payments.

Interest won’t be such a big deal if you are planning to stay in your home for good. However, if you’re planning to stay in your home for life, one thing you have to make sure is that the increased interest rate of your loan is around 5% and not10%.

Below we will provide in-depth details about the various options.

First Option: Tenure Payment Plan

In the tenure payment plan if at least one borrower lives in the home as a principal residence you will receive monthly payments that are equal. The payments you are paid on a monthly basis are calculated with the assumption that you will live up to 100 years. If you don’t expect to live that long a better option might be discussed.

This plan is beneficial for those who think that they’ll be able to live in the home for a long time and also for people that need monthly income that is stable.

The disadvantage of this plan is that in case you happen to have a large bill to pay off, it won’t help you that much.

Another disadvantage is that if you fail to pay the required property charges, happen to move out of your home because of sickness or any other issues, you won’t receive payments anymore unless you sort out the issues.

Second Option: Term Payment Plan

In the term payment option plan, your monthly payments which are equal are set for a period of time that you have chosen.

The advantage of this plan is that compared to the tenure payment plan, the monthly payments are higher. However, you should note that if your loan term reaches the end, you won’t receive any additional payments.

The drawdown of this plan is that unless you die during the loan term, you won’t have a steady income for life.

Third Option: The Line of Credit

In the line of credit plan, you have the freedom of accessing your money whenever you need it. You have the freedom of deciding the time you want to withdraw upon the credit line, and how much you want to take.

One huge advantage of the credit line payment plan is that it is quite flexible. You have the freedom of withdrawing a large lump sum of money and then borrowing more funds later on.

The disadvantage is that you can borrow the 60 percent maximum of your principal limit and then burn through your credit line.

Fourth Option: Modified Tenure Plan

In the modified tenure plan, as long as at least one borrower lives in the home as a principle residence, you will get a combination of access to a line of credit as well as fixed monthly payments.

The benefit of this plan is that it is quite flexible, since you can establish your own monthly payments and select your credit line.

The disadvantage is that this payment plan is not suitable for you if you need a large lump sum of money immediately.

Fifth Option: Modified Term Plan

In the modified tern plan you will receive fixed monthly payments for an agreed period of time. It can be several months, and you will also have access to your credit, although there has to be one borrower living in the home as a principal residence.

The advantage of this plan is that you get the flexibility of the size of the fixed payments that you receive on a monthly basis. Also, if you haven’t used up the credit line you can still access the loan proceeds at the end of the term.

The disadvantage of this plan is that you might run out of the proceeds of your reverse mortgage. The monthly payments that you receive are only set for a number of months or years. If you need a large lump sum of money upfront, then this payment plan is not suitable for you.

Conclusion

The various payment options are offered because senior homeowners have different financial needs. As you can see each of the payment plans has its own advantage and disadvantage. Strive to make sure you choose plan that is best suitable for you.