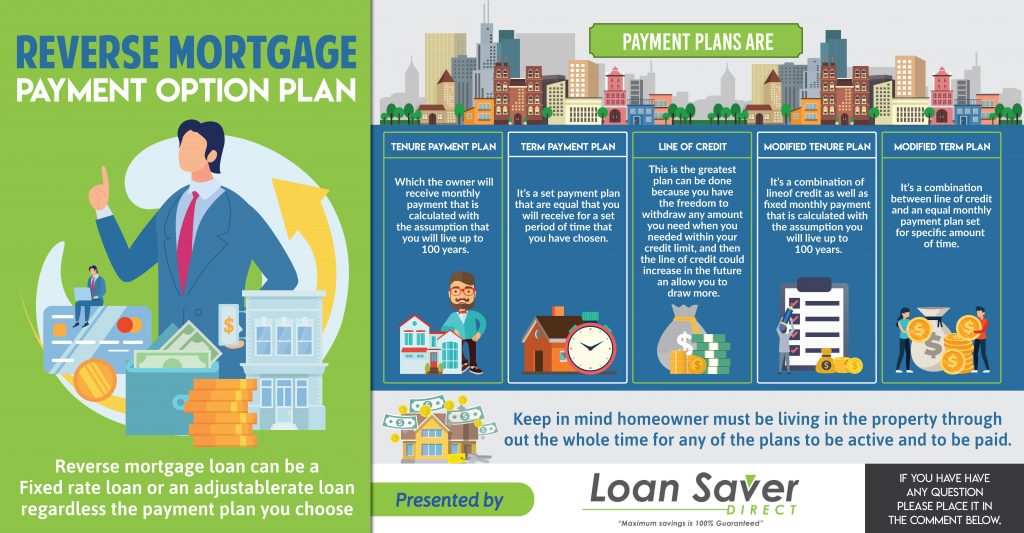

A tenure payment plan is one which a person draws funds from reverse mortgage proceeds. The borrower continues to get the same monthly payment so long as he or she lives in that property as their primary place of residence. The plan features interest which continues to accumulate on monthly payment as the borrower receives them. The interest can also accrue if there’s any financial closing cost such as ongoing mortgage payments. A sum of all these costs, that is, monthly tenure payments, interest, closing costs and mortgage insurance, is what the borrower will pay under the reverse mortgage tenure payment.

Familiarizing Yourself with a Tenure Payment

Compared to the Single disbursement plan, the tenure one has an initial lower interest. The most significant benefit of this payment is that the total interest could be less over time since the homeowner borrows money gradually, which has an initial lower interest. But, depending on the time you stay in the home, and how much the adjustable rates change over time, you could end up paying more than a person on the single disbursement plan.

Most people who take a tenure payment plan aren’t that concerned about the interest they pay in the long run. They just want a place to live in for the rest of their lives even as they age. The good thing with this payment is that you don’t have to worry about bankruptcy as it offers stability and predictability. However, this plan is not suitable for individuals who pay huge expenses at once or expect to have such large expenses in the future. For such a person, a lump sum which combines both the tenure payments with a line of credit is the best alternative.

Tenure Payment Plans Calculations

The lender often calculates the monthly payment as if the borrower will live up to 100 years. In case the borrower has a short life expectancy, the lender can offer a term payment plan that allows fixed monthly payment for the set years. This plan also allows the homeowner to receive a high monthly payment. But, should the borrower live past 100 years, they’ll still continue receiving life payments under the tenure plan.

In case where the borrowers are two on the reverse mortgage and one happens to die, the surviving one will continue to receive tenure payments for life. But, if only one of the two borrowers is a reverse mortgage one, and he or she dies, the surviving one will not receive any more payments as they weren’t a borrower. It’s therefore advisable, that if spouses are to sign up for this payment plan, they ensure that they include both their names so that even if one dies, the other will continue getting the payments.

How Much Do I Qualify For?

The amounts of funds you’ll receive on your reverse mortgage differ depending on the youngest spouse’s age and the appraised value of your home. The rule of the thumb, however, is, the loan to value offered on a reverse mortgage is 40-70% your appraisal value depending on your age.

Final Thoughts

Tenure payment plans offer the best alternative for those looking for a permanent place to stay until they pass on. However, before you quickly go to sign up for them, it’s wise that you speak to a financial advisor since, like any other payment plan, this one has its downside too.