If you own a home and have expenses that you need to pay, or you need a home remodel, but you run short on cash, you could qualify for a reverse mortgage or a home equity loan. Home equity loans and reverse mortgages allow people 62 and older to convert the equity in your home into cash without selling or moving. It helps to understand the difference between a reverse mortgage and an equity loan to help you decide which one will help you the most.

What is a Reverse Mortgage and How Does it Work?

You typically purchase your home with a standard, or forward mortgage. If you qualify for a mortgage from the lender, you pay on the principal monthly according to the details outlined in your agreement. As you keep making payments, the equity increases, the debt decreases, and you own the home.

A reverse mortgage works in the opposite way. Instead of making payments to the lender, the lender makes payments based on the value of your home. However, only this time, your debt and interest increase while the equity decreases. You have to pay the lender back the money if you don’t live there for a year or more, you sell, the home gets to a disrepair state, or you get behind on paying property taxes. In this situation, the lender sells the property to recoup the money they paid you, and the heirs inherit whatever equity remains in the home.

If you die before the year is up and your spouse’s name is on the deed, the bank cannot sell the home until the surviving spouse dies unless you are in one of the situations mentioned previously. Couples who are married or planning to marry should explore the reverse mortgage option and surviving spouse carefully. The interest grows for the duration of the mortgage, and the borrowers or heirs may not be able to use it for a tax deduction.

What is a Home Equity Loan?

One type of equity loan is a HELOC, or home equity line of credit. Sometimes called a second mortgage, it works similar to a reverse mortgage letting you change equity to cash. The lender loans you the money in one lump sum, then you pay off the loan, which commonly has fixed interest, according to the agreement.

HELOC allows you to borrow up to a predetermined credit limit and based on needs. You pay interest on the whole amount under a standard home equity loan.while under a HELOC you only pay interest on the withdrawn amount, Since HELOCs are flexible, the payments and interest can vary.

The interest paid on HELOC is no longer tax deductible unless you apply the money toward renovations. Before the tax codes changed in 2017, you could deduct part of the interest payments on your taxes. Another reason to carefully consider a HELOC is your heirs. If you default on the loan, the lender could foreclose on your home.

How Loan Types Differ

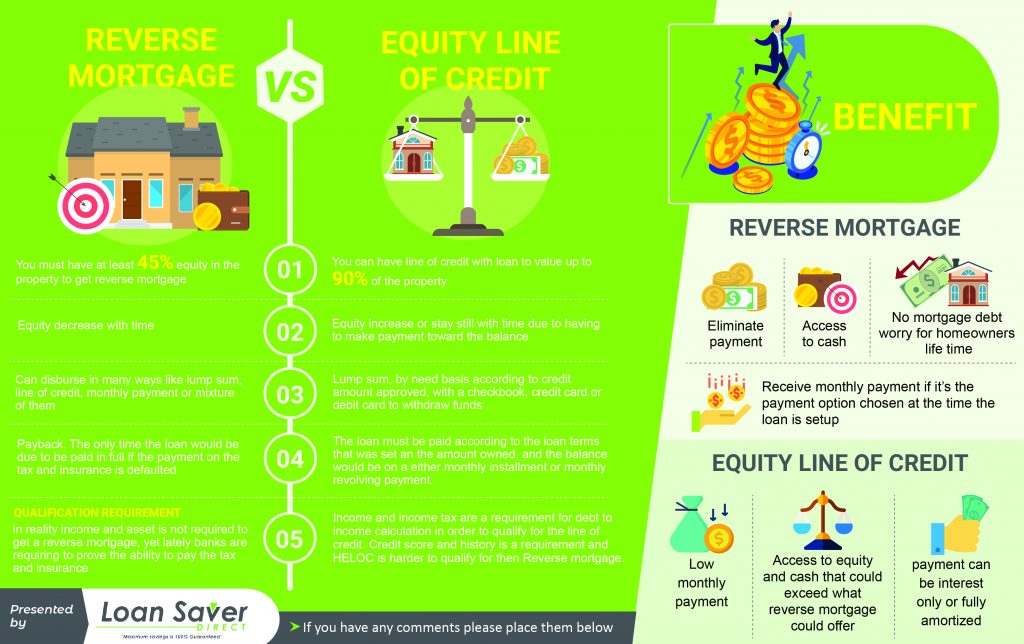

Home equity loans, HELOCs, and reverse mortgages have one thing in common, which is allowing you to change equity left in the home into cash. However, they vary on requirements, age, disbursement, tax deductions, interest, and payment terms. We explain the variations of these loans based on those factors.

The Manner of Disbursement

HELOC: You get a lump-sum on a by-needs basis according to the approved amount of credit. They commonly come with a checkbook, credit card, or debit card to withdraw funds.

Reverse Mortgage: You can get a monthly payment, line of credit, lump sum, or a mixture of them.

Home Equity Loan: You get one lump-sum payment.

Loan Payback Schedule

HELOC: You pay the loan back monthly according to the borrowed amount and current interest rates.

Reverse Mortgage: A full payment is expected if you become delinquent on house insurance or land taxes, or the home falls into disrepair, you live elsewhere for over a year, you pass away, or sell the property.

Home Equity Loan: You make payments based on a fixed schedule with a fixed interest rate.

Equity and Age Requirements

HELOC: You don’t have to be a certain age, but you need 20% equity in your home.

Reverse Mortgage: You have to 62 years old or older, own your home, and not have a large loan balance.

Home Equity Loan: No age limit, but you need 20% equity.

Income and Tax Requirements

HELOC: You need proof of stable income and a good credit score to pass financial requirements.

Reverse Mortgage: There are commonly no requirements for income, but the lender could check your credit history to determine if you can pay on time, which includes property taxes, homeowners association fees, and so forth.

Home Equity Loan: You must have proof of a steady income and a good credit rating to qualify.

Tax Benefits

HELOC: From 2018- to 2025, the interest cannot be deducted unless you use it toward a qualified purpose, such as renovation, or building or buying or home.

Reverse Mortgage: No tax benefits until the loan ends.

Home Equity Loan: See HELOC

Which Loan Is Right For You?

HELOC, reverse mortgages, and home equity loans all give you the ability to convert equity into the cash you need. The hardest part is choosing the correct loan to suit your needs.

A reverse mortgage makes an excellent choice for you if you are retired, looking for long-term income, don’t owe a mortgage or owe little on the mortgage, and you don’t plan to include the house as part of your estate. If you plan to marry or you are married, ensure you are both clear on the surviving spouse’s rights.

A HELOC or home equity loan makes a better option if you only need a short-term loan, you can afford the payments, and you want to keep the home as part of the estate. Each of these loans has their pros and cons, so study the options carefully before you decide on a loan.